Wednesday, September 8, 2010

Demand And Supply

Market : A group of buyers and sellers of a particular good or service.

Competitive Market : A market in which there are many buyers and many sellers so that each has a negligible impact on the market price.

Competition: Perfect and Otherwise:

Characteristics of a perfectly competitive market:

- The goods being offered for sale are all the same.

- The buyers and sellers are so numerous that none can influence the market price.

- Because buyers and sellers must accept the market price as given, they are often called “price takers.”

- Agricultural market provide good example of perfect competition.

- A market with only one seller is called a monopoly market.

- A market with only a few sellers is called an oligopoly.

- A market with a large number of sellers, each selling a product that is slightly different from its competitors’ products, is called monopolistic competition.

Demand:

- Quantity Demanded: the amount of a good that buyers are willing and able to purchase.

- Law of Demand: the claim that, other things being equal, the quantity demanded of a good falls when the price of the good rises.

Factors:

1. Price: Quantity demanded is negatively related to price. This implies that the demand curve is downward sloping.

2. Income: The relationship between income and quantity demanded depends on what type of good the product is.

- Normal Good: a good for which, other things equal, an increase in income leads to an increase in demand.

- Inferior Good: a good for which, other things equal, an increase in income leads to decrease in demand.

3. Prices of Related Goods

- Substitutes: two goods for which an increase in the price of one good leads to an increase in the demand for the other good.

- Complements: two goods for which an increase in the price of one good leads to a decrease in the demand for the other good.

4. Tastes and Preferences:

5. Expectations: This could include expectations of future income or expectations of future price changes.

The Demand Schedule and the Demand Curve:

- Demand Schedule: a table that shows the relationship between the price of a good and the quantity demanded.

- Demand Curve: a graph of the relationship between the price of a good and the quantity demanded.

Market Demand Versus Individual Demand:

- The market demand is the sum of all of the individual demands for a particular good or service.

- The demand curves are summed horizontally — meaning that the quantities demanded are added up for each level of price.

- The market demand is the sum of all of the individual demands for a particular good or service.

- The demand curves are summed horizontally — meaning that the quantities demanded are added up for each level of price.

- The market demand curve shows how the total quantity demanded of a good varies with the price of the good.

- Quantity Supplied: the amount of a good that sellers are willing and able to sell.

1. Price: Quantity supplied is positively related to price.

Law of Supply: the claim that, other things equal, the quantity supplied of a good rises when the price of the good rises.

2. Input Prices

3. Technology

4. Expectations

Market Supply Versus Individual Supply:

- The market supply curve can be found by summing individual supply curves.

- Individual supply curves are summed horizontally at every price.

- The market supply curve shows how the total quantity supplied varies as the price of the good varies.

Shifts in the Supply Curve:

1. When any determinant of supply changes (other than price), the supply curve will shift.

2. An increase in supply can be represented by a shift of the supply curve to the right.

3. A decrease in supply can be represented by a shift of the supply curve to the left.

Equilibrium (Demand & Supply are equal): The point where the supply and demand curves intersect is called the market’s equilibrium.

- Equilibrium: a situation in which supply and demand has been brought into balance.

- Equilibrium Price: the price that balances supply and demand.

- The equilibrium price is often called the “market-clearing” price because both buyers and sellers are satisfied at this price.

- Equilibrium Quantity: the quantity supplied and the quantity demanded when the price has adjusted to balance supply and demand.

- If the actual market price is higher than the equilibrium price, there will be a surplus of the good.

Surplus: a situation in which quantity supplied is greater than quantity demanded.

- To eliminate the surplus, producers will lower the price until the market reaches equilibrium.

- If the actual price is lower than the equilibrium price, there will be a shortage of the good.

- Shortage: a situation in which quantity demanded is greater than quantity supplied.

- Sellers will respond to the shortage by raising the price of the good until the market reaches equilibrium.

Law of Supply and Demand: the claim that the price of any good adjusts to bring the supply and demand for that good into balance.

Thinking Like an Economist

ECONOMICS a SCIENCE & POLITICS: The essence of Science however, is the scientific method – the dispassionate development and testing of theories about how the world works.

• The interplay between theory and observation also occurs in the field of Economics.

• The theory might assert that high Inflation arises when the government prints too much money.

• It gets proved when Economist collects and analyzes data on prices and money from country.

• Theory & Observation like science, they do face an obstacle that makes their task especially challenging.

• Experiments are often difficult in Economics – thus shows the sign of politics. A scenario of unanticipation.

THE ROLE OF ASSUMPTIONS:

• Making an assumption greatly simplifies the problem without substantially affecting the answer.

• Assumptions can make the world easier to understand.

• For Instance, once we understand International trade in an imaginary world with two countries and two goods, we are in a better position to understand International trade in the more complex world in which we live.

• Assumptions help knowing the magnitude of at least two or more variables impact in the given Economy.

ECONOMIC MODELS:

• The doctors use major plastic organs like – the heart, liver, kidneys etc. to explain how the body organs functions.

• Likewise, Economist also uses models to learn about the world, but instead of being made of plastic, they are most often composed of diagrams and equations.

• “Models are structures involving relationships among concepts”

• Economic models omit many details to allow us to see what is truly important.

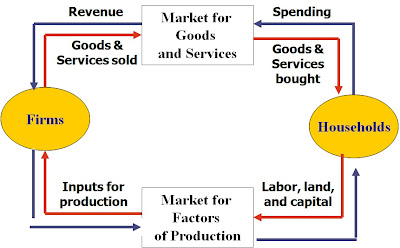

The Circular-Flow Model: The circular-flow model is a simple way to visually show the economic transactions that occur between households and firms in the economy.

The Production Possibilities Frontier: The production possibilities frontier is a graph showing the various combinations of output that the economy can possibly produce, given the available factors of production and technology.

Microeconomics and Macroeconomics:

- Microeconomics focuses on the individual parts of the economy. How households and firms make decisions and how they interact in specific markets

- Macroeconomics looks at the economy as a whole. How the markets, as a whole, interact at the national level.

Two Roles of Economists: When they are trying to explain the world, they are scientists. When they are trying to change the world, they are policymakers.

- Positive statements are statements that describe the world as it is. Called descriptive analysis.

- Normative statements are statements about how the world should be. Called prescriptive analysis.

Wednesday, September 1, 2010

Sunday, August 29, 2010

Assignment - 1 "10 Principles of Economics"

Tuesday, August 24, 2010

Ten Principles of Economics

Chapter - 1

Scarcity is taking over the world. “There just isn’t enough of anything” states the presenter; there is not sufficient money and time. Due to this we have to decide how to distribute these scarcities. “Decision making is the essence of economics” states Gregory Mankiw, every day we make decisions and choices that help us allocate our scarcities. “Economics is the study of mankind, in the ordinary business of life” was said almost a century old by Alfred Marshall. Gregory Mankiw says that quote “captures economics perfectly” and it does, it studies the decisions we make in order to deal with this scarcities, we make decisions and choices every day, when we go shopping and choose what to buy, since there is an scarcity of money, when we go to work and choose how many hours to work because there is an scarcity of life and etc. We impact and shape our economy with every decision we make.

1. Trade offs (People Face Trade offs):

As we make decisions we make tradeoffs, which mean we choose something over something else, or we have to give up something in order to have something else. Decisions such as having a child involve a tradeoff between money for yourself, and money to buy the child his necessities; it also involves trading off time, since you are giving up your personal or free time, for the time to give to the baby. In the movie a very good example of tradeoff is shown. It shows a college student that wants to move to Washington when he finishes college, and gives up some of the time he uses to study for tests or exams, for time to look for jobs in Washington. Choosing his priorities over other ones makes him face a trade off. Society as a whole also involves tradeoffs; the government has to choose how much money to use in certain aspects of the country. Something that I personally liked and made me think was when the movie shows how we face trade offs even in the environment, “We all want cleaner air but the tradeoff can mean loss of income or even the loss of jobs for some Americans” says the presenter. I didn’t understand the relationship of this two until they talk about a coal company in Ohio that had to be shut down because it was being harmful to the environment, the consequences? More than a thousand persons lost their jobs, the community decided to have a cleaner environment, but the tradeoff was the losing of the jobs of all those people.

2. Opportunity Cost (The cost is something you give up to get it):

What you sacrifice in order to get something is its cost. The presenter and Gregory Mankiw explain this principle with a college student. By choosing to go four years to college the student’s costs are many. There is the cost of the money she is spending in books and tuition, and also the “opportunity costs” as said by Mr. Mankiw because since she decided to go to college she is giving up the opportunity of getting a job and the wages of the job she would’ve taken. “Nothing comes for free, our time is worth something” says Todd Buchholz an economist that makes you realize that a cost of something is not always involved with money; the cost of something you do can be as simple as spending time with loved ones. This segment of the movie contrasts to situations in where the opportunity cost varies, an example shown is how the opportunity cost of a college student is reasonably low, since the student is giving up low paying jobs, but the opportunity cost for a very talented high school athlete offered to go straight to professional is very high, because if he decides to go to college he is giving up the millions of dollars he would earn being a professional athlete.

3. Marginal Thinking (Rational People think at the margin):

A rational person like the college student shown in the movie thinks at the margin, when given too much college work instead of quitting the job that earns her money for her personal spending, she simply cuts back a little on the work hours. She is not radical; she is adjusting instead of finishing, she is thinking at the margin. Another good example is that of a Broadway that sometimes faces empty seats. So thinking at the margin they decide to bargain with the public and sell them the seats at half the price some hours before the show instead of having empty seats in the show. Adjusting the ticket’s price actually gains the theater more revenues because even if it’s earning them 50% of the original cost, that’s more than zero, if the seats would’ve stayed empty. By being rational and thinking at the margin better decisions and choices can be made.

4. Incentives (People respond to Incentives):

When the cost and the advantages of something vary or change, our decisions change too. “If I want my son to wash my car I’ll say if you was my car you can use it tonight, that’s an incentive” says Robert Sobel from Hofstra University and for me is the best explanation for incentives. The incentive is that he can use the car that night, in other words he benefits from saying yes, but if they weren’t any incentives, he’ll probably doubt it. A very good example they give on how we respond to incentives, and applies to today’s situation, is that of how we response to the prices of gasoline. In Europe the price of gasoline is very high, this incentive makes people buy smaller and more economic cars, in contrast to America where the price is still relatively low, and people buy vans and big cars. Didn’t you notice that the stores and streets were packed the “Tax Free Week” here in Florida? That is because people are responding to incentives, incentives that benefit them; obviously you’ll do more shopping if you are not going to be taxed. When President Clinton was in office, he asked for the cigarettes prices to go up by a dollar and a half, because it was demonstrated that young people would not buy cigarettes and smoke. This is a perfect example of a disincentive since this discourages the youth from smoking. Another point explained is the behavior some people take with incentives. Nowadays safety belts are required because is proven to save lives but in the other hand “there is evidence that behavior does change in response to these safety belts” states Mr. Gregory, since some people exceed speed limits because they feel more secure.

5. Trade (Trade can make Everyone Better Off):

Since we are not self-sufficient we trade. “People specialize; people do particular tasks and rely on other people to do other tasks for them” says Mr. Gregory. A hairstylist for example trades her service (that is cutting hair) for money, and the other person relies on her the hairstylist to get her hair cut. “The idea of: I have something and you have something and if we exchange it we are both going to be better off, is fundamentally what economics is all about” states Caroline Hoxby. We as humans and to be able to survive we trade, we exchange, we rely. This is explained in another example shown in the movie. We rely in a group of specialized farmers to grow the food for us, we both benefit since we get the food and they are paid for producing the food. Countries also trade between them when they sell each other products that they are good at making cheaper. We trade every day in order to survive.

6. Markets ( Markets Are Usually a Good Way to Organize Economic Activity):

In markets agreements are made, and prices are settled, which then are communicated to the world. In the food market farmers sell their goods, and supermarket owners buy them to then sell it. Anothertype of market is the Stamp Market. Mark Easter a stamp dealer explains that it is like the stock market where the dealers go for the highest price offered. The first person who explained how a market system works was Adam Smith the grandfather of economics published the first book about economics called “The Wealth of Nations” in 1776. How can buyers and sellers interact to each other and not create chaos? Adam Smith said “that markets are guided as if by an invisible hand at least to a desirable allocation of resources.” We all have interests, and if we all try to achieve them, we are all going to be happy. The invisible hand is explained in the movie with a simple example from Mr. Sobel he says, “If I have a $25 dollars and you have a good and you want to sell it to me, we both win, you wanted the $25 dollars more than the good, and I wanted the good more than $25 dollars.” The key of the invisible hand are prices, the sellers and consumers depend on them. When communism fell in Russia and Eastern Europe it showed that free market is the best way to operate, since people know what they want, how the want it, at how much they want to buy it and etc.

7. Government (Governments Can Sometimes Improve Market Outcomes):

Sometimes the government gets involved in developing better outcomes. This happens when any of two situations happens. First if the market outcome is not efficient, and second if it fails to distribute the income efficiently. In many cases, externality is the cause of failure. “Externality is when a company or an individual creates something that has an impact beyond the immediate buyers and sellers of that product. Electricity plants are obviously benefiting the users and buyers of electricity but it also has an externality since the smoke produced by them can harm the health of a person. Market power can also lead to market failures, since a certain firm or person’s services is outsized and can control and influence prices. When the market is not being fair the government also intervenes. Some people get paid for their services more than other; this is something that cannot be controlled by the invisible hand. When the government gets involved is because the situation is very complicated, the more complicated it gets, the harder it gets for the government to fix it.

8. Productivity (A Country's Standard of Living Depends on Its Ability to Produce Goods & Services):

Statistics show that in 1998 the average American had a yearly income of $31,500, the average Mexican of $8,300 and the average Indian of $1700. You can notice that their quality of life is not the same for example Americans live better than Indians. Productivity explains it all; a rich country produces more than a poor one. And productivity depends on skills, capital and etc. If a country has a well educated work force, productivity will rise. Economic freedom and liberty means more productivity. An ideal example is the US and Hong Kong, where people are free to use their brains to create goods, services, or ideas that can be taken to the market where consumers take advantage of them.

9. Inflation (Prices Rise when The Government Prints Too Much Money):

This basically means inflation which means that prices rise in order to mirror all the money that is being print out. The printing of money is something that needs to be controlled because even though it might “temporarily make the people feel wealthier” as said by Todd Buchholz, at some point prices will start going up, and inflation will come in play, and it will be very hard to take back under control. Stability between goods and money is the best way to keep inflation away.

10. The Phillips Curve (Society Faces a Short-run Trade Off between Inflation & Unemployment):

The Federal Reserve Chairman is supposed to maintain unemployment low, and inflation under control. Mr. Mankiw states that you can’t achieve both goals at the same time and that the policy instrument is money supply. When one goes up the other one goes down and vice versa, this is called The Phillips Curve. As stated in the movie this is a short run tradeoff, you have to choose on over the other one. But nowadays this tradeoff does not really exist because in the past year both inflation and unemployment has gone down. This doesn’t mean that The Phillips Curve would not come in play again, some economists say it will.

Understanding these 10 principles is the key to understanding the whole concept of economics.

Greetings

Congratulations and welcome to the new Academic Year 2010-11. This is going to be the final year of your M.B.A. programme and at the end of this you will be ready to face the market.

I wish you all the best for the coming year and also wish to tell you that enjoy this year at the fullest as this time is not going to come again.

Be prepared and always expect the unexpected!!!!!!